do nonprofits pay taxes on rental income

If you expect to owe at least 1000 in income tax on your profit you are supposed to prepay these taxes to the IRS during the year. No Tax Knowledge Needed.

However member dues to 501 c 10 organizations go toward social and recreational purposes and not toward benefits for.

. For example if your nonprofit earns any income from activities unrelated to its purpose it will owe income taxes on that amount. Unrelated business income is typically derived from nonmembers with certain modifications see section IRC 512 a. Tax-exempt organizations also known as 501 c 3 organizations can have Unrelated Business Taxable Income UBTI when the organization has revenue streams outside of its direct charitable purpose.

While the income of a nonprofit organization may not be subject to federal taxes nonprofit organizations do pay employee taxes. Dividends interest rents annuities and other investment income generally are excluded when calculating UBIT. While rental income from real property is generally tax exempt this rental income may become taxable depending on factors such as the tenants activities and whether the nonprofit provides services to the tenant.

However theres more to the story. Which Taxes Might a Nonprofit Pay. While nonprofits can usually earn unrelated business income without jeopardizing their nonprofit status they have to pay corporate income taxes on it under both state and federal corporate tax rules.

There are certain circumstances however they may need to make payments. But determining what are an organizations exempt purposes is not always as clear as one might think and distinguishing between related and unrelated activities can be tricky. There are 24 of the gross property rental income taxable in Canada per year under the Canadian Income Tax Act.

Rental property owners can. Any nonprofit that hires employees will also. If you rent real estate such as buildings rooms or apartments you normally report your rental income and expenses on Form 1040 or 1040-SR Schedule E Part I.

While nonprofits are generally tax-exempt they must pay income tax when operating outside the scope of their exempt purposes. Ad TurboTax Makes It Easy To Get Your Taxes Done Right. If the nonprofit uses the property for an unrelated business it pays tax as described in Form 598.

It is a myth that a nonprofit cannot earn a profit. List your total income expenses and depreciation for each rental property on the appropriate line of Schedule E. And while churches are not allowed to turn a profit.

File With Confidence Today. Should you pay tax on rental income. The IRS defines unrelated business income UBI as income from a trade or business regularly carried on by a nonprofit organization that is not substantially related to the performance by the organization of its exempt function.

The short answer is that rental income is taxed as ordinary income. One source of UBI is rental income. For example if your top bracket is 24 and your annual rental profit is 4168 youll owe 1000 in income tax.

Rental Income and UBTI A Look at the IRS Guidance to Its Auditors. Rental income from real property is taxable. But if yours does 1 it should not be too substantial and 2 it could be taxable despite your tax-exempt status.

UBI can be a difficult tax area to navigate for non-profits. Because churches operate to serve peoples spiritual needs foster a sense of community and undertake charity they are tax-exempt and allowed to accept tax-free donations. Answer Simple Questions About Your Life And We Do The Rest.

You may be able to. Published on September 4 2014. Generally speaking rents from real property are excluded from UBTI.

There are clear rules as well as several exceptions to. For the most part nonprofits are exempt from most individual and corporate taxes. A non-profit organization NPO as described in paragraph 149 1 l of the Income Tax Act.

If youre in the 22 marginal tax bracket and have 5000 in rental income to report youll pay 1100. However there are two exceptions where this type of income is taxable. An agricultural organization a board of trade or a chamber of commerce as described in paragraph 149 1 e of the Act.

2 days agoHelping business owners for over 15 years. Churches and religious organizations are almost always nonprofits organized under Section 501 c 3 of the Internal Revenue Code. Below is a beginners guide intended for high-level determination of whether rental income is subject to unrelated business income tax reporting for tax-exempt entities.

However not all rental income is subject to unrelated business income. The amount of tax youll have to pay on your rental income depends on your top tax bracket. This guide is for you if you represent an organization that is.

This article contains some basic advice to consider before you foray into using your property for rental profit. You use Form 990-T for your tax return. For non-residents however completing an NR6 form allows them to elect to pay 25 of the rental income after expenses.

Below well detail two scenarios in which nonprofits pay tax. A nonprofit must utilize all revenue to operate the organization. Nonprofits are also exempt from paying sales tax and property tax.

If the nonprofit uses the real estate purely for its mission -- a historic society that owns historic buildings say -- theres no tax on the gains when the property is sold. Generally the first 1000 of unrelated income is not taxed but the remainder is Lets go back to the Friends of the Library nonprofit.

Donation Receipt Template Receipt Template Receipt School Fundraisers

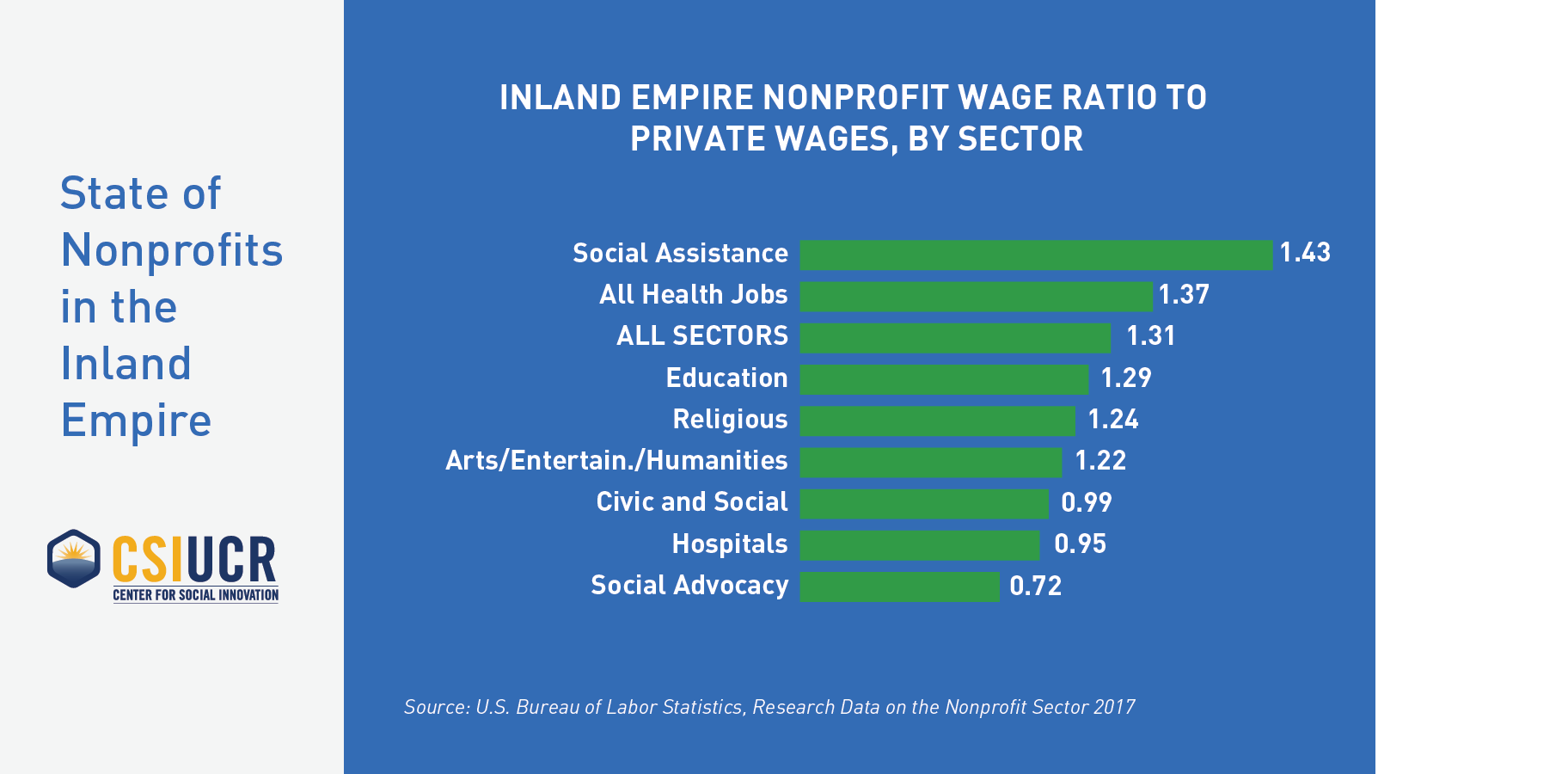

State Of Nonprofits In The Inland Empire Center For Social Innovation

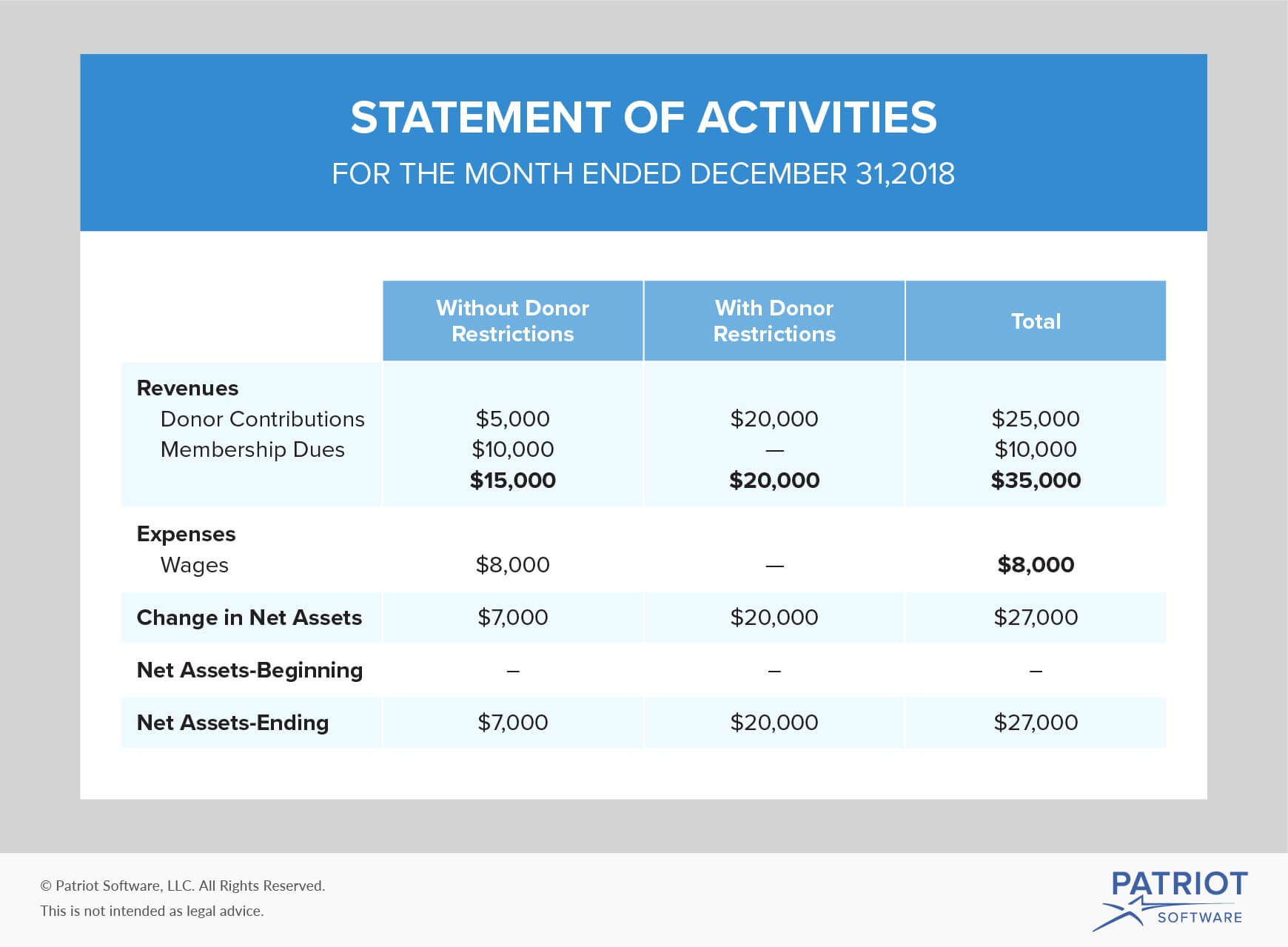

Back To Basics Nonprofit Financial Statements Altruic Advisors

7 Leasing Tips For Nonprofits The Nonprofit Centers Network

To Buy Or To Rent Evaluating The Right Path For Your Non Profit

Pin By Letter Writing Tips On Fundraising Letters Business Letter Sample Fundraising Letter Letter Example

Lease Non Renewal Letter Sample Bagnas Letter Of Not Renewing Lease Https 75maingroup Com Rent Agreement Being A Landlord Lettering Letter Of Employment

Misuse Of Funds Nonprofit Help Fraudulent Misappropriation Charity Fundraising Nonprofit Fundraising Non Profit

Common Ubit Myth Related To Nonprofit Revenue And Tax Impact Nonprofit Accounting Basics

Pin By Jason Ritter On Quick Saves Internal Revenue Service Tax Forms Fillable Forms

Back To Basics Nonprofit Statement Of Financial Position Altruic Advisors

Know These Costs Before You Start Your Nonprofit In 2021 Non Profit Startup Funding Grant Writing

Do Nonprofit Organizations Pay Property Taxes In Canada Ictsd Org

Nonprofit Chart Of Accounts Template Double Entry Bookkeeping Chart Of Accounts Accounting Downloadable Resume Template

Accounting For Nonprofit Organizations Financial Statements Beyond

/not_for_profit_nonprofit_charity_AdobeStock_93906620-2ce63147cc814bd3b25984ee637c3bac.jpeg)

Charitable Contributions Tax Breaks And Limits

Free Cash Flow Forecast Templates Smartsheet Cash Flow Budget Forecasting Personal Finance Budget

Rt Stoweboyd There Isnt A Single State City Or County In The U S Where Someone Earning Federal Or State Minimum Wage For A 40 Hour W Apartment Cost Rent Map